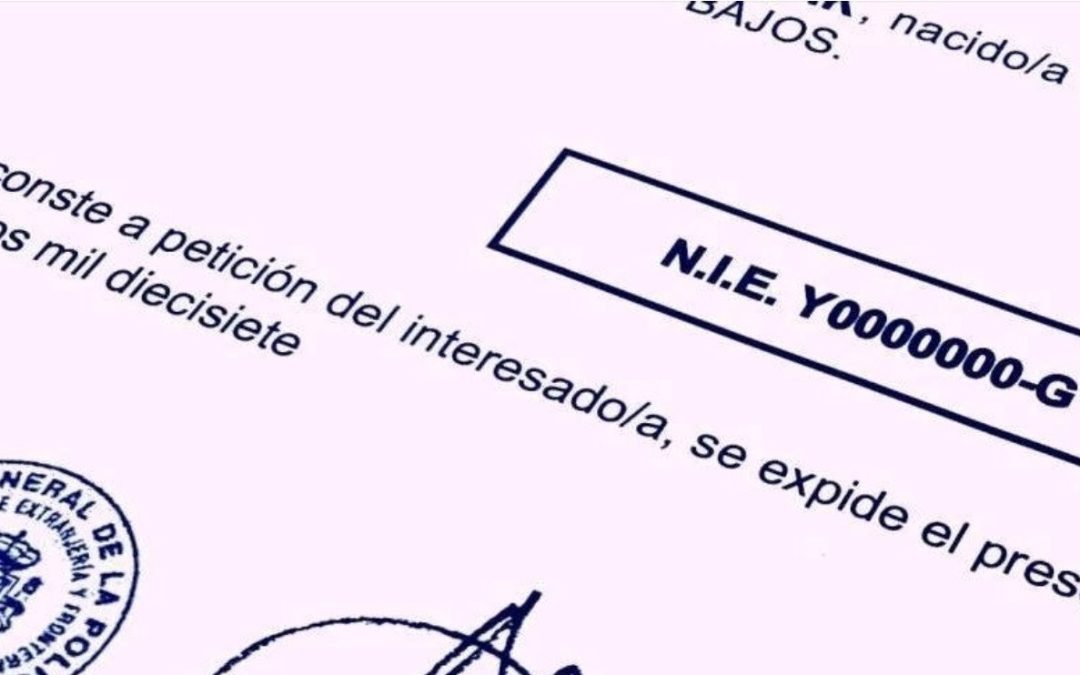

A Número de Identidad de Extranjero (Spanish Identification Number for Foreigners) is a personal, unique, and exclusive number assigned to foreigners who are engaged in activities related to Spain for economic, professional, or social reasons.

This unique tax identification number is required for almost every Spanish transaction or official procedure within the country and therefore acts as your fiscal identification. The most common examples of transactions include:

- Buying or selling property in Spain

- Renting a property

- Studying in Spain

- Opening a Spanish bank account

- Setting up a phone contract/utilities

- Getting a Spanish driver’s license

- Becoming employed in Spain

- Applying for a Spanish residency

Without an N.I.E number, the Spanish tax authorities will not be able to process any annual tax payments, including income tax (IRPF) and the annual wealth tax (Patrimonio), which are both mandatory in Spain for both residential and non-residential property owners.

While securing an N.I.E. number appears straightforward on paper, it can be frustrating. It involves navigating through Spanish bureaucratic procedures, which can vary depending on the region and specific offices. Further, the applicant must provide a specific set of documentation and correctly filed forms and usually experiences long wait times for an appointment.

At Marc White & Co., with our expertise in cross-border Anglo/Spanish law, we can help assist our clients to successfully obtain their individual N.I.E numbers without complication.

If you require an N.I.E number because you are either planning on purchasing a property in Spain, looking to study at a Spanish University, or are seeking residency in Spain, please contact us directly by email (info@mwsolicitor.com) or by calling our office (+44 (0)117 946 7709) for further advice.