Owning a Property in France: Taxe d’Habitation

If you are a homeowner in France or are planning to become one, you need to be aware of the property taxes for which you will be liable (regardless of whether you are making income from the property). The taxe d'habitation is a local property tax in France,...

Owning a Property in France: Understanding the Taxe Foncière

If you are a homeowner in France or are planning to become one, you need to be aware of the taxes for which you will be liable for simply owning the property (that is, irrespective of whether you are making an income from it). The land tax, known as "taxe foncière" in...

The Role of French Lawyers in International Estates

Handling international estates involves navigating different legal systems, tax regulations, and inheritance laws. For UK residents with assets in France or beneficiaries across borders, understanding French law helps to ensure a smooth process. French lawyers play a...

Understanding French Law: A Guide for UK Residents

Navigating the French legal system can be challenging, especially for UK residents unfamiliar with its structure, as there are some key differences from UK law. If you’re looking to buy property, set up a business, or need legal assistance for immigration or criminal...

Estate Planning for High-Value Estates in Spain

Estate planning is a critical process for anyone with significant assets in Spain, especially those with high-value estates. The Spanish inheritance system, with its own set of rules and regulations, requires careful attention. For international clients with assets in...

Choosing the Right Spanish Lawyer for Your Needs

When dealing with legal matters in Spain, selecting the right Spanish lawyer can make a significant difference. Spain's legal system is quite different from that in the UK, so it's essential to work with a lawyer who understands the nuances of Spanish law. Whether...

Guide to selling a property in Spain

Selling a property in any country can be both stressful and complex. In England and Wales, from completing forms such as the TA6 and TA10 to answering numerous legal and general enquiries, clients often struggle to fully understand the conveyancing process. In Spain,...

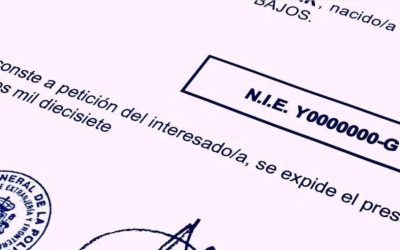

What is an N.I.E and why is it so important?

A Número de Identidad de Extranjero (Spanish Identification Number for Foreigners) is a personal, unique, and exclusive number assigned to foreigners who are engaged in activities related to Spain for economic, professional, or social reasons. This unique tax...

The End of the Golden Visa in Spain

Yesterday, Thursday 14 November 2024, the Spanish government voted to end the ‘Golden Visa’, a type of visa that grants residence permits to foreigners who make significant investments in the country. This measure has been included in the Law for the Efficiency of...